"jjhats" (ssaxman)

"jjhats" (ssaxman)

10/05/2015 at 11:58 ē Filed to: None

1

1

16

16

"jjhats" (ssaxman)

"jjhats" (ssaxman)

10/05/2015 at 11:58 ē Filed to: None |  1 1

|  16 16 |

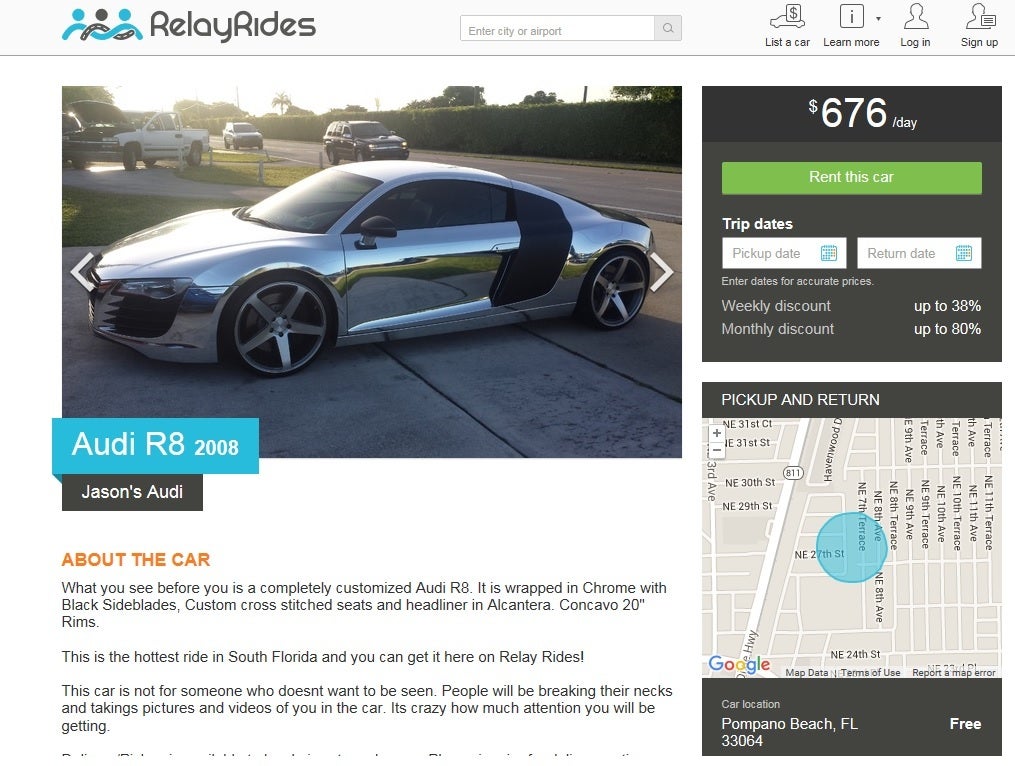

So what would potentially stop me from buying an r8 at a 2k a month loan and then advertising it on relay rides for 500. All it would take is 4 rentals a month for me to own it for free. How is this any different from buying property with the intent to rent it out? Talk me down oppo

djmt1

> jjhats

djmt1

> jjhats

10/05/2015 at 12:00 |

|

What about insurance?

jjhats

> djmt1

jjhats

> djmt1

10/05/2015 at 12:01 |

|

would geico care if this thing gets rented out more than a dirty motel after prom night?

FazeRacer

> jjhats

FazeRacer

> jjhats

10/05/2015 at 12:02 |

|

Will someone actually rent the car 4 times a month? What if you have months nobody rents it? Property rental is the same way, I know people have had a house vacant for a year because they couldnít find tenants.

Twingo Tamer - About to descend into project car hell.

> jjhats

Twingo Tamer - About to descend into project car hell.

> jjhats

10/05/2015 at 12:02 |

|

Running costs and maintenance would kill the break even idea. Plus the fear of someone thrashing your car.

FazeRacer

> jjhats

FazeRacer

> jjhats

10/05/2015 at 12:02 |

|

Yes, yes they would.

daender

> jjhats

daender

> jjhats

10/05/2015 at 12:03 |

|

Worst idea, because someone would hoon it and crash it and then thereís one less R8 in the world.

bob and john

> jjhats

bob and john

> jjhats

10/05/2015 at 12:03 |

|

they would care a lot actually

jjhats

> Twingo Tamer - About to descend into project car hell.

jjhats

> Twingo Tamer - About to descend into project car hell.

10/05/2015 at 12:03 |

|

its an audi whats the worst that could happen? /s

Sir Classy III

> jjhats

Sir Classy III

> jjhats

10/05/2015 at 12:05 |

|

You could compare this to a rental property. That being said I feel the risk associated with a car are much higher than those with a house/apartment. For example I think it is much easier to get into a car crash than it is to accidentally burn down a house. Not to mention I donít think that your car insurance provider will be too fond of this. Iíd love to hear from someone who is currently doing this though.

TractorPillow

> jjhats

TractorPillow

> jjhats

10/05/2015 at 12:05 |

|

Are you interested in starting a business or just ďrentingĒ out your ride. Insurance wonít like the latter and starting a business has all kinds of other considerations.

On the other hand, I like where your head is at.

Sampsonite24-Earth's Least Likeliest Hero

> jjhats

Sampsonite24-Earth's Least Likeliest Hero

> jjhats

10/05/2015 at 12:05 |

|

Wrapped around a light pole

jjhats

> TractorPillow

jjhats

> TractorPillow

10/05/2015 at 12:06 |

|

im interested in owning a supercar for free not starting a business

Daily Drives a Dragon - One Last Lap

> jjhats

Daily Drives a Dragon - One Last Lap

> jjhats

10/05/2015 at 12:11 |

|

Someone would crash it for sure.

FazeRacer

> jjhats

FazeRacer

> jjhats

10/05/2015 at 12:14 |

|

Here, read this about the liabilities you could be facing:

http://www.forbes.com/sites/investopÖ

RockThrillz89

> jjhats

RockThrillz89

> jjhats

10/05/2015 at 12:58 |

|

Youíre still going to have to pay taxes on that income. So youíre going to need to do more than 4 a month. At which point youíre pretty much forced into being a business. And if you make the car a business car and depreciate it, you then have to claim income on the amount of personal use. Or at least keep it separated, but then youíre only picking up partial depreciation expense. And if you sell it it, you have to worry about how much of the gain or loss is business and how much is personal (canít deduct personal loses, but have to claim the gain). Then you have to worry about repairs and maintenace, and how itís paid for and how much is a business expense. But you could deduct part of your interest as business interest expense.

Oh, since youíre going to have to put it on your tax return anyway so you could pick up any benefits, you need to decide what type of business. C-Corp, S-Corp, Partnership, Sole Proprietor. So then the business entity owns the car, not you (except sole proprietor, but you donít want to do that since you have 100% liability), so now you do have to claim personal use as income. Then when the car is paid for, you have to buy it from the company if you want to own it. And donít think you could just send the company a $1 check. Thatís a related party transaction, which means you canít deduct the loss on the sale (not to mention your personal basis of $1 in the car, so get ready for that gain if you ever sell it). Also, youíre going to get audited to ensure that the business wasnít set up as what amounts to a personal checking account (only in this case, a car).

Thatís just

some

of the tax considerations at the Federal level. Have fun at the state level.

Thereís a reason people donít do this.

Nisman

> jjhats

Nisman

> jjhats

10/05/2015 at 20:45 |

|

Call an insurance agent. Last car I bough they asked me if it would be used as a ride share type deal.